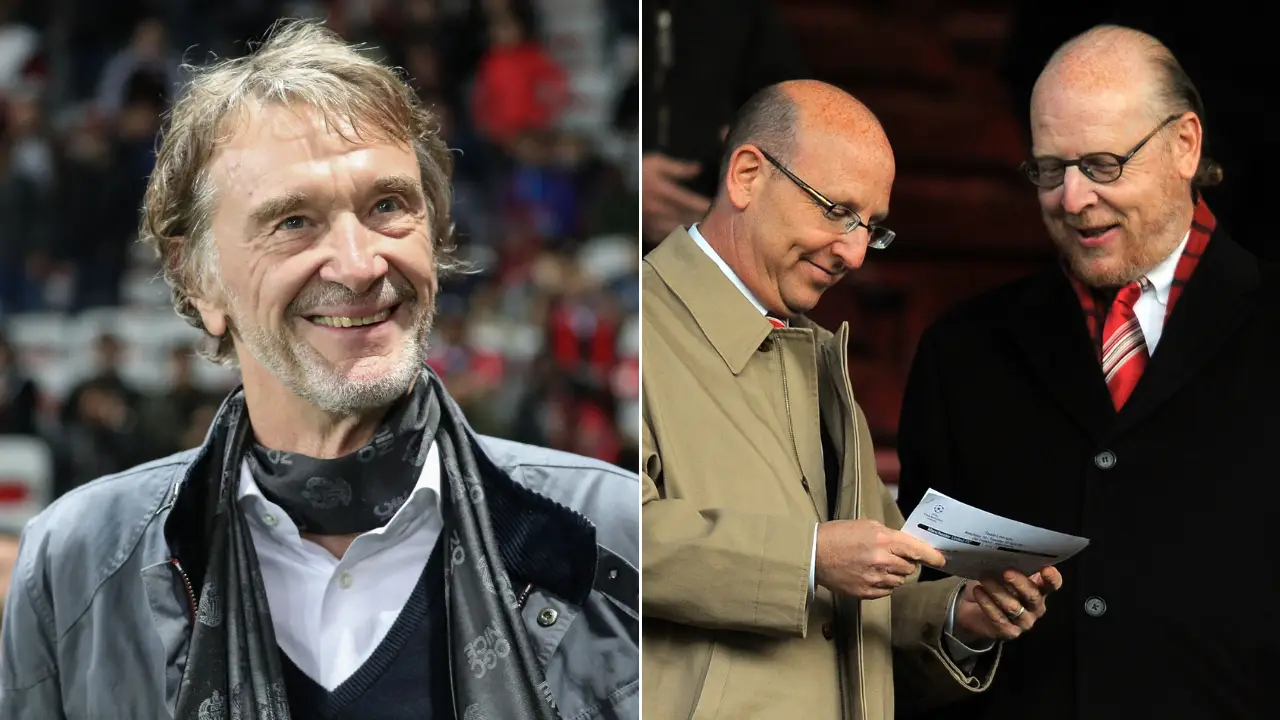

Sir Jim Ratcliffe has reportedly agreed a deal to acquire a 25 per cent minority stake in Manchester United - and a social media thread has outlined how he could deal with the club's debt.

Ratcliffe's offer will be voted on at an emergency board meeting later this week, as per The Athletic, and reports claim that he and his petrochemicals company, INEOS, will be in charge of football operations at United should the deal go through.

The 70-year-old, who is a boyhood United fan, has a major task on his hands at Old Trafford, with the club's stadium in dire need of renovation and its debt levels continuing to rise.

United were taken over by US businessman Malcolm Glazer in 2005, via a leveraged buyout (LBO).

Advert

Glazer used loans to fund the majority of the capital needed to buy United, and most of those were secured against club assets.

This meant (via The Athletic) that United were in £660 million of debt when the takeover of the club was finally completed, with half of the borrowing placed on the club, which was also paying interest. That debt has since been refinanced.

Furthermore, The Athletic add that, for the four years after 2006, the club paid an average of £95 million per year in interest, more than a third of the club's total earnings, to service the debt that arose from the leveraged buyout.

At the heart of this is one of the primary reasons why the Glazer family has been unpopular with a large section of the Unted fanbase.

A viral thread on X (Twitter) from user @Ole_is_right has explained United's current debt situation - and the likely ways in which Ratcliffe could look to pay it off.

The user claims that Ratcliffe came either pay off the debt immediately, or refinance it.

The user says it is 'likely' that the INEOS chief will look to repay it via financing from a third party - which would explain reports from the Daily Mail that he had enlisted banking giants JP Morgan and Goldman Sachs as advisors during the early stages of the bid process.

There is also the claim made that INEOS - a company that states it generates annual revenues of $65 billion - could assume the club's liability.

The user then adds: "On top of this lack of need for the club to pay out, the debt itself would be set at much more favourable terms because it would be coming from a single lender (as opposed to many VC creditors and banks under the LBO)."

Should Ratcliffe solve the major debt issue at United, it would get his stewardship of the club off to a good start.

SPORTbible are on WhatsApp! We've launched a dedicated news channel to send you the latest news, features and plenty more directly on WhatsApp and all you need to do to sign up is click through to our one-way broadcast channel here for 'SPORTbible News' to appear in the 'Updates' tab on your WhatsApp.

Topics: Manchester United, Premier League, Sheikh Jassim